Behavioral Finance

You might wonder: if the contrarian value strategy does so well, why doesn't everyone use it? This lands us smack in the realm of investor psychology (or behavioral finance, as it is now called by economists).

Conventional financial theory assumes that all investors are rational. However, in reality, emotions can often lead to irrational investment decisions, creating bubbles and panics. Behavioral finance offers clear explanations where current financial theory often fails to recognize and possibly take advantage of mistakes both professionals and individual investors make.

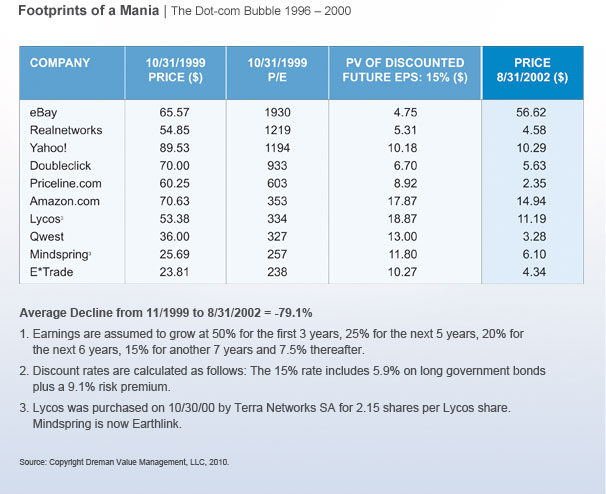

Though the statistics drag us toward the value camp, our emotions just as surely tug us the other way. People are captivated by exciting new concepts. The lure of hitting a home run on a hot new idea overwhelms caution. The sizzle and glitz of eBay at 1,930 times earnings or Yahoo! priced at 1194 times earnings is just too great.

While these are extreme examples of investor evaluation run amok, they show why value strategies have worked so well over the years. People pay for concept, whether in the absurd cases of eBay or Yahoo!, or in consistently overpricing the trend industries of the day. Investors just as surely want to stay well away from companies whose outlooks seem poor.

Most investors have a negative reaction to contrarian stocks. Recall that these companies violate just about every idea of proper investment theory. The favored stocks, on the other hand, present the best visibility money can buy. How, then, can one recommend such a reversal of course?

The psychological consistency of the error is remarkable. There are, of course, excellent stocks that justify their P/E ratios, and others that deserve the slimmest of multiples. But, as the evidence indicates, these are relatively few and the chances of recognizing them are very small.

Trouble is, human beings are poor forecasters, especially in a rapidly expanding, complex, multinational business environment. Even a 1-cent miss in the forecast sometimes results in a stock dropping 20% or more.

When low P/E stocks receive disappointing news, they just shrug it off. Positive surprises, on the other hand, send value stocks soaring but have little impact on favorites.

We believe that contrarian strategies succeed because investors don't know their limitations as forecasters. As long as investors believe they can pinpoint the future of favored and out-of-favor stocks, you should be able to make good returns on contrarian strategies.

For more information on behavioral finance, please refer to the News & Resources section of the website.

Contrarian InvestmentStrategies: The Next Generation by David Dreman, Chapter 7